17.07.2023 | Simply explained: Why the electricity price can be negative

Negative electricity price: Predictable trend?

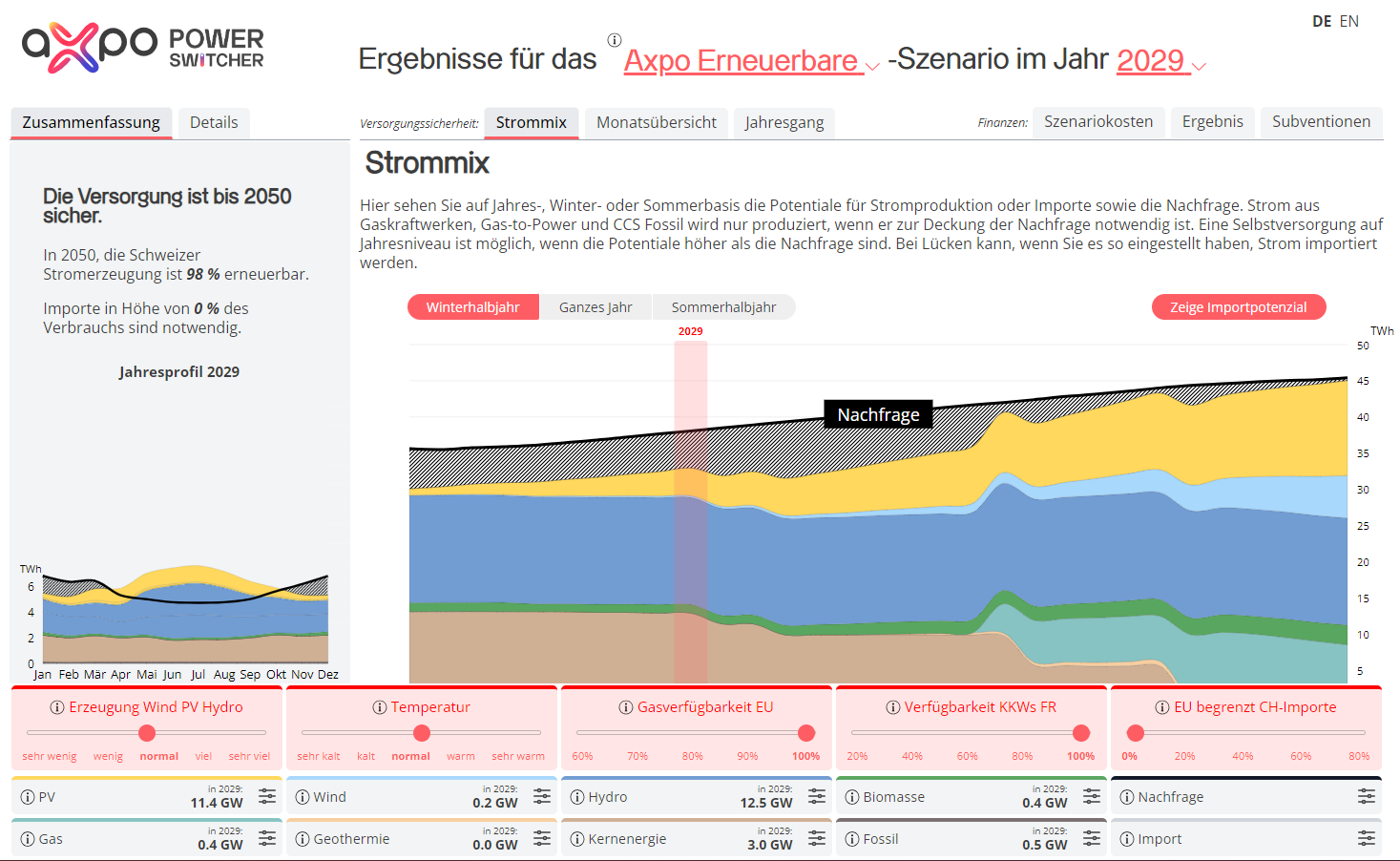

First sporadically and now more frequently again: Why is the electricity price negative and what is the effect? We explain how this happens and whether it will go away on its own. Small spoiler: There will still be negative electricity prices in the next five years.

Basically, the electricity price is created by supply and demand on the short- and long-term electricity markets. The negative electricity price is the somewhat curious situation in which money is paid in order to purchase electricity. In other words, a company runs its machines at a flexible rate - they get paid for using the electricity when too much is being fed in.

Swiss companies can profit

This is, so to speak, like an extreme variant of the low tariff at the end customer. And here we come to something important: since the market in Switzerland is only partially liberalised, the negative electricity price has no influence on the end customer in Switzerland. A private household has a fixed price. And can actually only choose whether electricity is consumed at low or high tariffs.

In Germany, however, where the market has been fully opened up, the first tariffs for end customers are based on the prices on the short-term markets. These customers can profit, but also pay correspondingly more in case of price spikes upwards.

In contrast to the residential market, the market opening applies to the wholesale market. Large customers can therefore decide for themselves whether they want a fixed tariff or variable tariffs. The better they can shift their load, the more likely they are to take a variable tariff - from which they benefit when prices are negative.

The typical day: Sunday, noon, wind and sun

Typically, a negative electricity price occurs on a Sunday at noon or on a public holiday when little electricity is consumed and a lot of electricity is produced - for example, because there is a lot of wind or the sun is shining and wind and solar energy is being produced.

Now you could simply stop another production - but it's not that simple.

We asked Thomas Weber, energy economist at Axpo, what you need to know about the negative electricity price.

Thomas, if too much electricity is being produced, why not stop production?

The electricity producers really have to consider whether they want to produce at all in these moments. We try to use our flexible power plants in such a situation. We try not to produce where possible, but also to use electricity to pump up water, for example at the PSWL (Limmern pumped storage plant). Where possible, we try to fill storage lakes for a time when electricity prices are positive again. So it's an advantageous situation for pumped storage - but the demand from pumped storage also helps to dampen or avoid negative prices.

After all, those who sell the electricity take in less when it is sold so cheaply or even at negative prices.

Whether you produce or not, however, depends on various factors. For example, there are the power plants where it is too expensive to switch off and on again.

Or those that can't at all - a run-of-river power plant, for example. For example, we have run-of-river power plants that cannot be switched off for concession reasons, and for these negative prices are not positive.

Why do production peaks occur at all?

In the original promotion of wind and solar plants, the same feed-in tariff was always paid, no matter when feed-in took place. If there are many such plants, this is definitely a driver for negative electricity prices. As of 2017, however, subsidies in Germany have been made "smarter", especially for large plants. For them, it is now worthwhile to stop production when prices are negative. Regulation has also been improved for new small plants, but they still increase the tendency to negative prices somewhat. If old large-scale plants gradually fall out of the subsidy system, the situation will improve. In Switzerland, however, the problem is much smaller overall than in Germany. However, it is also a fact that Switzerland is catching up (proportionally) with Germany in terms of PV installations. In terms of PV systems on roofs, it is - proportionally - almost on a par.

What is different in Switzerland than in Germany?

There are far fewer plants with fixed feed-in tariffs in Switzerland, and the expansion of PV and wind has been much lower than in Germany. The price troughs are precisely when renewables produce a lot. In addition, much more can be stored in Switzerland in relation to consumption because of the pumped storage facilities.

If renewables are expanded - will negative electricity prices become more frequent?

First yes, then no. For example, small rooftop installations receive fixed tariffs and are continuously added. This means that negative prices will remain an issue that will perhaps increase somewhat. But plants are no longer subsidised, especially in Germany, and the flexibility of demand is also increasing, which smoothes out the price again. For example, when solar cells are linked to batteries, or electric cars are "cleverly" charged. Unfortunately, there are still no tariff models in Switzerland that reward flexible demand. Today in Switzerland, the production costs (manufacturing costs) are the decisive factor for the electricity price for end customers. The complete opening of the market would help to modernise the tariff landscape.

Does the negative electricity price slow down the expansion of renewables?

Not all renewables are subsidised, or the subsidy is limited in time. Then the revenues have to come from the market, and negative prices hurt, of course. This risk is taken into account in investment decisions, which can slow down the expansion. At Axpo, the goal is to have a balanced technology and country mix.

Is the negative electricity price something new?

The energy shortage of the last two years has lifted the whole electricity price level so high that there has not been a negative electricity price for a while now. Thus, the accumulation trend was interrupted. Now that the electricity market has calmed down a bit, we are seeing it more frequently again: zero and negative prices are reappearing.

What will happen next?

Initially, the frequency will increase, but in the long term, i.e. towards the end of the decade, it will decrease again. Production will continuously become smarter and demand will become more flexible, and so the negative prices will slowly disappear again.

Further information

Listen also to Chief Economist Martin Koller on SRF Rendez-vous (de): Negative electricity prices - who benefits?

For more information on electricity prices in general, read the interview with Chief Economist Martin Koller here.

.jpg)