19.10.2023 | The future of the Swiss electricity market following the consolidation bill

More renewable energy, smaller market role

On 29 September 2023, parliament passed the "consolidation bill" with the aim of revising the legislative foundation of the Swiss electricity market. But what has actually changed? The new provisions place a particular emphasis on the expansion of renewable energies. Unfortunately, they don’t include market deregulation, which would have opened up a major new course of action.

The "consolidation bill" (an amendment of the Electricity Supply Act and the Energy Act) passed by parliament on 29 September 2023 is probably the most important legislation package for the Swiss electricity market in recent years. It came after the last differences between the chambers were ironed out in the autumn session. The chambers had been debating the sweeping changes for a year and made numerous amendments to the version originally communicated by the Federal Council.

Ambitious targets

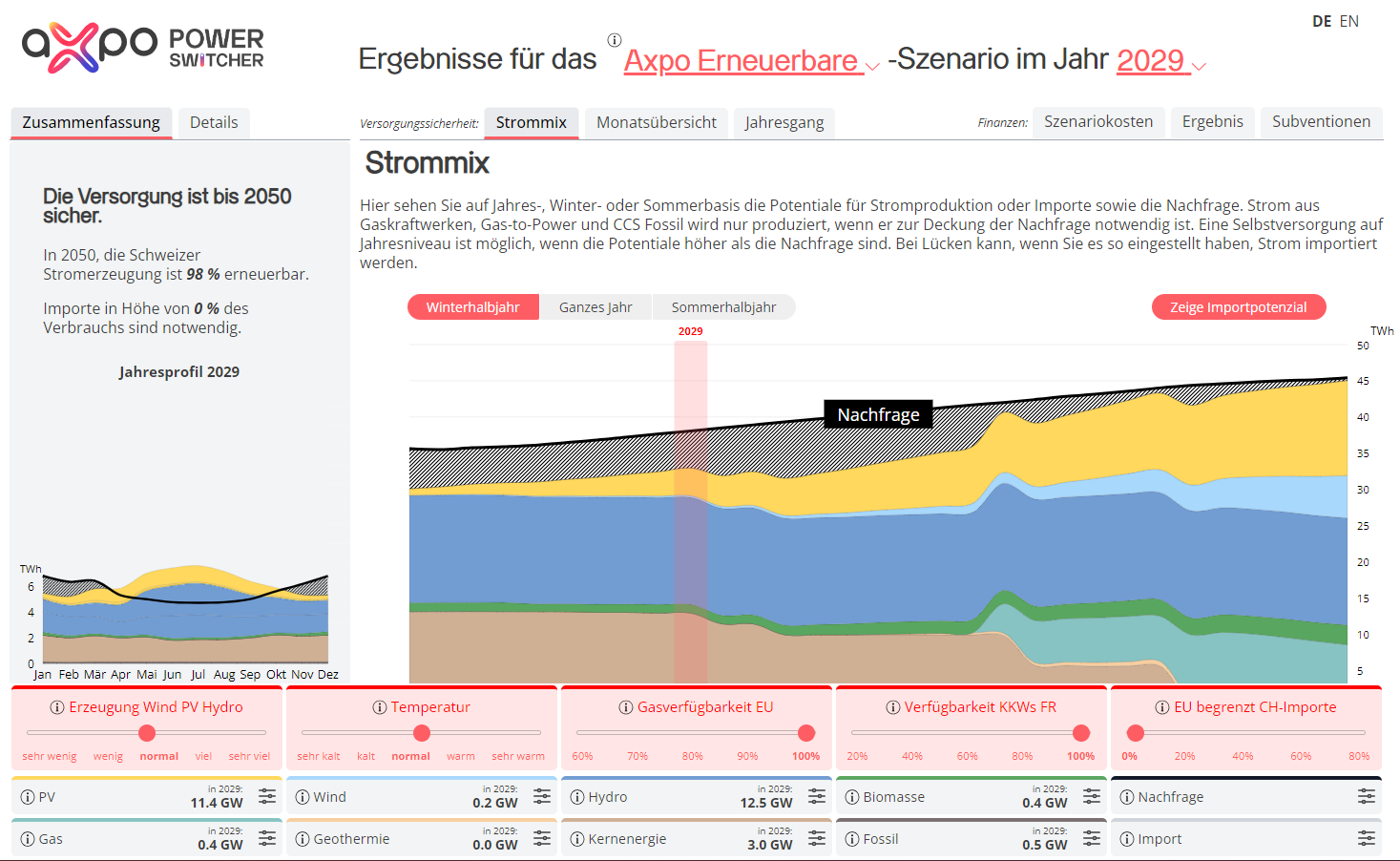

The core of the consolidation bill is the set of new targets for the expansion of renewable energies. They mandate that a total of 35 TWh of new renewable electricity production (solar, wind, biomass) be added by 2035, and as much as 45 TWh by 2050. This is an enormous challenge. As a comparison: the annual production of electricity from renewable energy sources (excluding hydropower) is currently just 8 TWh; Switzerland’s total annual energy consumption is around 62 TWh. The new legislation only allows for a modest increase in electricity from hydropower; the potential of this source has largely been exhausted while stricter residual water requirements will require losses of 2–7 TWh to be offset. There are also targets related to net import volumes for electricity in winter, which are not meant to exceed 5 TWh. Finally, total energy consumption and electricity consumption per capita should be reduced by 43 percent and 13 percent, respectively, by 2035.

Better framework conditions for renewable energies

The new legislation offers various measures for stimulating the expansion of renewable energies.

First, there are improved framework conditions for large-scale installations. The cantons are expected to nominate areas for renewable energies – now explicitly including solar installations. Solar installations and wind farms in these areas are defined as being of ‘overarching interest’, which will improve their chances in weighing up construction against environmental and conservation interests. For hydropower, a list of 16 projects (Hydropower Round Table and Project Chlus) with a total additional potential of 2 TWh of winter electricity were included in the law, and they will benefit from simplified approval processes. Accompanying this, targeted exceptions to construction bans for renewable energies in protected areas have also been introduced, and the national interest of renewable energies boosted overall.

Second, an alternative funding instrument has been created in the form of the floating market premium, which allows hedging against fluctuating market prices and offers developers of large-scale installations greater investment security. This includes the ‘winter bonus’, an incentive for greater electricity production in winter. For greater flexibility around financing for funding, there is now an option to exceed the network supplement fund.

Third, smaller plants will also benefit from simplified approval processes. Plants on roofs and facades with the requisite adjustments will no longer require approval under the new law, will generally be zone-compliant on larger parking areas and will be eligible for approval under certain criteria even outside building zones. The current (provisional) mandate for solar installations on new builds of 300 m2 or more is now permanent, but parliament rejected an extension of this provision to include refurbishments.

Fourth, a nationwide uniform return tariff for renewable energies will be introduced. This is essentially aligned with the market price determined each quarter. There will also be minimum remuneration (but no maximum) for smaller solar installations (<150 kW), which will be aligned with the production costs of reference installations. Claims for minimum remuneration in low-price phases will be met by consumers covered by basic supply, where the electricity will be sold.

No to complete market deregulation

The complete deregulation of the market didn’t have a chance of getting through parliament. This means that households and small-scale consumers won’t be able to choose their supplier in the future. This rejection means that consumers will remain subject to the procurement strategy of their supplier in a monopoly arrangement. Rejection of complete deregulation also removes a basis for greater innovation (e.g. electricity products and integrated solutions) and – increasingly important – the expansion of consumption flexibility.

However, the local electricity community (LEC) model has been approved – a kind of "market deregulation lite" that will bring consumers and generators together. In contrast to existing self-consumption solutions, participants will now be able to exchange internal electricity through the public distribution grid and will receive a discount on their grid usage tariffs. The legislation restricts expansion of an LEC to "the area of a municipality at most".

The provisions for procurement under basic supply have also been amended. The average pricing method that attracted industry criticism and caused distortion with its blend of procurement for basic supply and the free market has been abolished and replaced by an alternative system. Suppliers will now procure separately by segment and include a minimum share of their own production (if any) in the basic supply at a rate set by the Federal Council. On top of in-house production, a further minimum share of energy will stem from domestic long-term contracts for renewable electricity production. As an extra condition, suppliers will have to offer a standard product from ‘primarily’ domestic renewable energies.

More obligations, less market

On the issue of energy efficiency, parliament is focusing on obligations. To reach the targets set by parliament, electricity suppliers will now be obliged to impose energy efficiency measures on their Swiss end consumers that will affect "existing devices, installations and vehicles", or purchase corresponding certificates. Here, the Swiss Federal Office of Energy (SFOE) will define the annual targets and the corresponding catalogue of measures. This means that parliament is rejecting incentives in favour of a new, wide-reaching system in which energy suppliers will be forced into areas of activity that don’t align with their core business. It is impossible to say at this point how high the (administrative) costs of this system will be, but it is the end consumers who will ultimately have to pay.

Parliament has also introduced an obligation around the formation of the hydropower reserve for which the consolidation bill provides a legislative foundation. Instead of contracting out the reserve through tenders as they have to date, storage power plant operators will now be obliged to retain a part of their energy for emergencies and will receive administered compensation. This breach of economic freedom and the guarantee of property sends a negative signal for investment in renewable energies and storage.

Key signals rather than revolution

Barring a referendum, the consolidation bill will enter into effect on 1 January 2025. There are also further changes, such as in the grid area (including smart meter provisions, solidarisation of grid upgrade costs, handling flexibilities) and concerning hydrogen (national interest, site dependency criteria, partial grid fee exemption). An exhaustive overview of all changes would exceed the scope of this article, and many changes still have to be defined in detail at the ordinance level (consultation Q1, 2024).

Overall, we can conclude that the consolidation bill represents a key, positive signal for the expansion of renewable energies and in particular for large-scale plants. It remains to be seen how much of this plays out in practice. The key factor will be whether or not the cantons earmark sufficient areas for renewable plants. Accelerating expansion will also require streamlining of the approval process. The consolidation bill didn’t specifically address this issue as it is the subject of a separate draft, the "acceleration bill", which is now up for debate in parliament.

At the same time, the consolidation bill is a missed opportunity for completely deregulating the market and for focusing on market incentives rather than regulations. The implementation of additional regulations at ordinance level and in practice will present countless challenges. Some concepts may seem reasonable in theory, but the complexity of the electricity market is such that they can only be implemented through numerous additional regulations and inefficiencies. There is only one solution for a truly cost-effective energy transition: The Power of Markets.

.jpg)